The South African economy has long been considered to have immense potential. However, it is also known for its structural issues, which limit its growth potential. The South African economy has faced tough economic times, but it has also experienced some growth due to various factors. In this article, we will delve into the current economic outlook of South Africa, exploring the factors that contribute to its resilience in the face of tough times.

Current Challenges and Sentiment Analysis

Weak Domestic Demand:

The South African economy faces a range of challenges that contribute to negative sentiment among businesses and consumers. These challenges include declining real household income, rising food prices, frequent electricity load-shedding, high unemployment, income inequality, high public debt level and other factors that impact consumer sentiment. Additionally, retail trade sales have fallen, reflecting the impact of these challenges on consumer spending.

External Position and Fiscal Deterioration:

South Africa’s external position has reportedly gotten worse, with trade surpluses fluctuating and external accounts needing to be supported by foreign capital flows, according to a PwC outlook report. Concerns about the growing fiscal deficit and the nation’s debt-to-GDP ratio are raised by the poor fiscal position, which is made worse by falling commodity prices and lower corporate income taxes. Government revenue assumptions have been deemed optimistic, further adding to the risk of a deteriorating fiscal situation.

Geopolitical Factors and Economic Impact:

South Africa is no exception to the rule that geopolitical issues can have a big impact on a nation’s economic future. The United States has expressed disapproval over recent events and controversies involving South Africa’s relations with Russia. These actions have the potential to hamper South African exports under the African Growth and Opportunity Act (AGOA). While no economic retaliation has occurred thus far, the tensions highlight the need for South Africa to carefully navigate its international relationships to safeguard its economic interest

Surprising Developments in Confidence and Sentiment Outlook

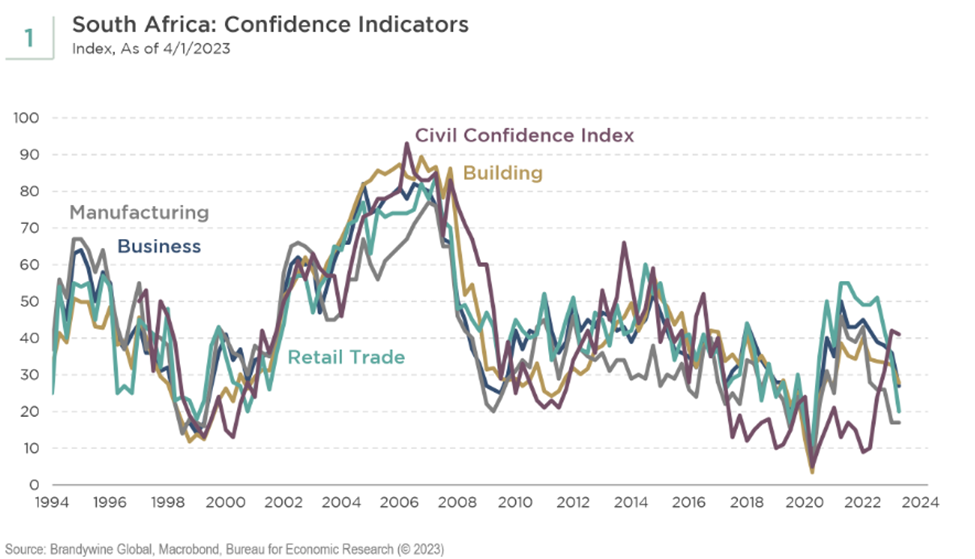

Looking at the recent release of the RMB/BER business confidence index in South Africa, in our opinion, South Africa has room to grow. Trading Economics reports that South Africa’s business confidence index recovered some ground to reach 33 in Q3 2023, up from an almost three-year low of 27 in the prior quarter. It is still pessimistic, though, because of the ongoing issues like high lending rates which are a burden on consumers, and societal unrest that keeps businesses under pressure.

Consumer-facing industries like retail and the auto industry, however, showed a recovery (+32 vs +20), as profitability increased as a result of slower price increases despite dismal sales. Additionally promising, the minor decrease in load-shedding frequency helped several businesses, particularly those in manufacturing (+23 vs +17).

South Africa’s Confidence Indicators

South Africa Business Confidence Index Explanation:

‘In South Africa, the BER Business Confidence Index covers 1,400 business people in the building sector, 1,400 in the trade sector and 1,000 in manufacturing. The survey assesses the level of optimism that senior executives in the companies have about current and expected developments regarding sales, orders, employment, inventories and selling prices. The index varies on a scale of 0 to 100, where 0 indicates an extreme lack of confidence, 50 neutrality and 100 extreme confidence.’

Understanding the Key Drivers of the South African Economy

Despite these difficulties, South Africa’s economy has proven resilient and has even managed to surprise analysts with its recent economic performance. For instance, despite widespread expectations that the economy would enter a recession in the first quarter of the year, output only slightly increased. Despite being small, this surprising increase had a wide basis and was supported by industries like manufacturing, financial, real estate, and business services. Despite ongoing difficulties, these encouraging achievements show that the South African economy can continue growing.

Services sectors and domestic trade: The financial, transportation, and personal services sectors, in particular, have been important growth drivers. Domestic trade has also helped the economy to grow.

The resilience of private business: Private businesses have persevered despite the economy’s sluggish development, which has resulted in a significant rise in employment of 784,000 jobs (5.0%) in the year ending 2023Q2. This increase in employment demonstrates how private companies can endure the detrimental effects of power outages and supply chain disruptions.

Improvements in energy generation: The pipeline of 10,000 MW in private sector energy production projects is tracked by Operation Vulindlela, which has helped to improve the prospects for commercial activity and economic growth outlook for 2024. To promote future growth, major reforms to address the energy problem are required.

Monetary policy normalization: In 2024, it’s anticipated that the repo rate will decrease, returning to pre-pandemic levels and supporting household expenditure.

Rise in employment and declining inflation: The strong increase in employment has been accompanied by a slowdown in inflation, which helps ease the decline in consumer buying power.

Conclusion

Patrick Bradley described South Africa’s growth as uninspiring, and the country has flirted with recession. Patrick further alluded that although it hasn’t happened yet, a recession could happen if business and consumer confidence drop. The restoration of global growth, driven by a recovering China, might provide a significant economic boost in the future. That resurgence would benefit mining in South Africa and might slow the widening of the budget deficit by increasing income.

IMF research team has stressed the need for structural reforms, including addressing energy and logistical constraints, reducing barriers to private sector investment, and tackling labour market rigidities, which are needed to achieve job-rich, inclusive, and greener growth. The below image summarises key policy priorities which South Africa should incorporate to have sustainable economic growth that is inclusive.

South Africa’s Should be Policy Priorities (Source: IMF)

Sources: IMF WorldBank PwC-1 PwC-2 PwC-3 BrandyWineGlobal TradingEconomics